Portugal

Residency & Citizenship by Investment

One of Europe’s oldest countries, positioned on the blissfully elegant shores of the Atlantic ocean, Portugal boasts a rich historical and architectural heritage. Luminosity, radiance and culture beams through whitewashed villages and lush vineyards.

WHY CHOOSE PORTUGAL?

Portugal boasts a rich and diverse culture, Mediterranean climate, and a safe and stable setting, which is an ideal location for raising families, conducting business or simply enjoying travel. Investors find many opportunities in Portugal’s secure and fast-developing market with access to the entire Schengen zone.

Country highlights:

- Most welcoming country for expats, by InterNations

- 4th most peaceful country in the world, by Global Peace Index, Institute for Economics & Peace

- World’s Leading Destination, by World Gold Awards

- Europe’s Leading Destination, by World Gold Awards

Program benefits:

- Visa waiver to enter, live and work in Portugal;

- Visa-free travel within the Schengen member states;

- Qualification for permanent residency and citizenship of Portugal after 5 years of temporary residency;

- Qualification for citizenship of newborns when one of the parents has valid residency for a minimum of 1 year and the birth occurs in Portugal;

- Family reunification allowed to spouse or de facto partner, dependent children and dependent parents.

Qualifications

Portugal’s Golden Visa Program is offered in accordance with the Ministry of Internal Affairs through the Agency for Integration, Migration and Asylum (AIMA).

Aimed at attracting foreign direct investments to the country, the program yields a residency permit in Portugal to non-EU investors who meet the following requirements:

- Invest in one of the available options by transferring funds to Portugal from abroad;

- Submit the required documentation per applicant, including clear criminal record (when applicable);

- Pay Government fees and all remaining expenses associated with the selected investment;

- Attend appointment allocated in Portugal for physical submission of application and collection of biometrics (valid Schengen visa required, when applicable);

- Meet or exceed the minimum stay requirements (14 days per each 2-year period once residency cards are issued).

INVESTMENT OPTIONS

Establishing the program in 2012 and being the first country to offer a Golden Visa, Portugal remains one of the most popular options for investors seeking European residency, having surpassed the €5 billion mark in foreign direct investment.

Over the years, the program has offered investors a diverse range of qualifying options while also evolving to focus on key strategic areas of economic development. Under the latest iteration of the program, investors can choose from the following investment options to qualify for the Golden Visa:

Capital Option

- €500,000 – Acquisition of participation units in venture capital or investment funds.

Capital and Employment Option

- €500,000 – Incorporation of a company in Portugal that creates 5 permanent jobs, or investment in an existing company with the creation of 5 permanent jobs or maintenance of at least 10 jobs.

Donation Options

- €500,000 – Investment in research activities;

- €250,000 – Investment in arts or the reconstruction of national heritage projects.

Job Creation Option

- 10 jobs – Investment on the creation of new registered labor contracts.

APPLICATION FEES

The fees associated with this program cover service for the main applicant and all qualifying family members throughout the first application for temporary residence. Additional fees are applicable depending on the investment option selected.

Translation, notarization and authentication of documents at all stages of the process are the responsibility of the investor.

All application fees and taxes charged by the Portuguese government and by entities external to Arton are subject to change without prior notice.

DO I NEED TO LIVE IN PORTUGAL TO MAINTAIN MY RESIDENCY?

DO I HAVE TO PAY ANY TAXES IF I DON’T LIVE IN PORTUGAL?

NEXT STEPS:

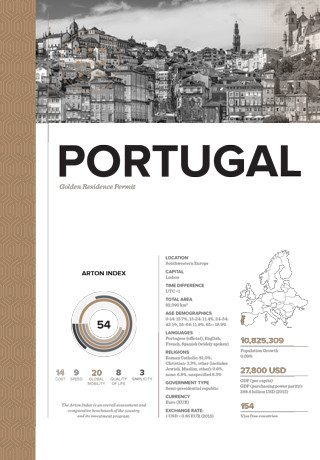

ARTON INDEX SCORE

0

- 0 cost

- 0 speed

- 0 global mobility

- 0 quality of life

- 0 simplicity

Updated yearly, the Arton Index is an overall assessment and comparative benchmark of the country and its investment program.

10,833,816

Population Growth: 0.07%

28,500 USD

GDP (per capita)

GDP (purchasing power parity)

297.1 billion USD

175

Visa free countries

LOCATION

Southwestern Europe, bordering the North Atlantic Ocean, west of Spain

CAPITAL

Lisbon

DIFFERENCE

UTC 0

TOTAL AREA

92,090 sq. km.

AGE DEMOGRAPHICS

0-14: 15.50%, 15-24: 11.4%, 24-54: 41.88%, 55-64: 12.07%, 65+: 19.15%

LANGUAGE

Portuguese (official), Mirandese (official, but locally used)

RELIGIONS

Roman Catholic: 81%, Other Christian: 3.3%, Other (includes Jewish, Muslim, Other): 0.6%, None: 6.8%, Unspecified: 8.3%

GOVERNMENT TYPE

Semi-presidential republic

CURRENCY

Euro (EUR)

EXCHANGE RATE

1 USD = 0.9214 EUR