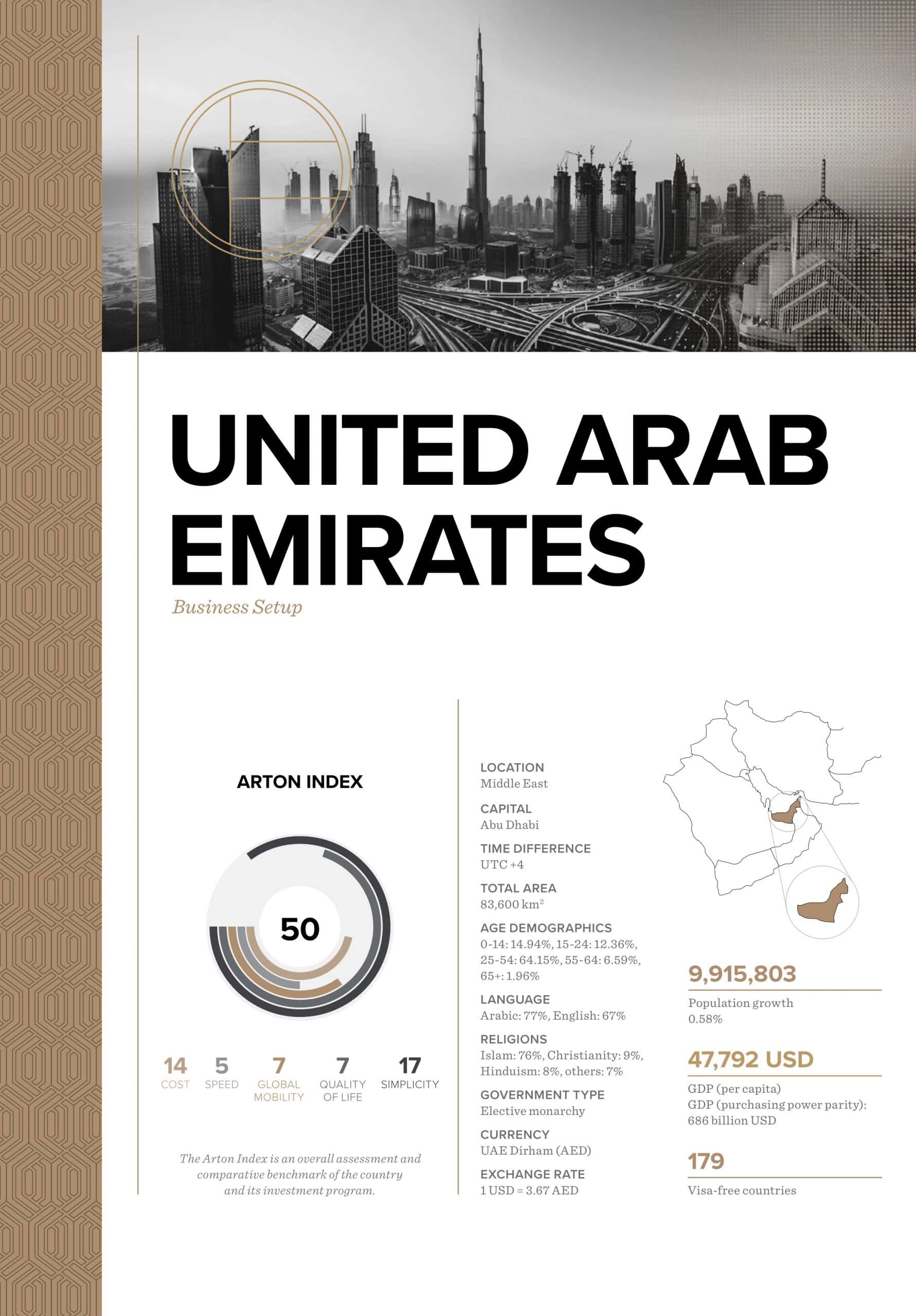

United Arab Emirates

Business Setup

From the tallest building on Earth, the world’s only 7-star hotel, to the largest dancing fountain, and the fastest rollercoaster, the United Arab Emirates is known for breaking records unimaginable. This is the place where aspirations become reality.

WHY CHOOSE THE UAE?

The United Arab Emirates is a cultural melting pot that brings together people from all over the world, each with their own unique story and a diverse set of skills that make this country the place to be.

Situated on the crossroads of the Middle East, Asia, Europe, and Africa, with excellent air and sea connections with the rest of the world, the country bears great strategic importance for global business.

The UAE has also started offering its own Golden Visa, which enables expats to live, work and study in the country without the need for a national sponsor, and with 100% ownership of their business in the UAE.

With no corporate tax, high economic diversity and state-of-the-art infrastructure, the United Arab Emirates presents endless opportunities for businesses to thrive.

LICENSE OPTIONS

To set up a company in the United Arab Emirates, there are five main categories of licenses to select from depending on your goals:

- Professional;

- Commercial;

- Trading;

- Industrial;

- Tourism.

AVAILABLE PATHWAYS

The United Arab Emirates has three pathways to company registration: mainland for global trading, free zone for 100% foreign ownership in the free zone, and offshore for tax optimization.

Mainland

A mainland company is nothing but an onshore company which is registered under the government authority of the concerned emirate. The trade license is issued by the Department of Economic Development of the particular emirate. A UAE mainland company is mainly characterized by the liberal trading conditions. Unlike the other two types of companies, a mainland company has the advantage of receiving authorization to trade both on the UAE local market and outside the UAE.

Free Zone

A free zone company is a company formed within a special economic area within an emirate where goods and services can be traded. There are more than 40 free zones operating in the UAE. Free zones have their own regulations and have a government regulatory body called the Free Zone Authority. The Free Zone Authority is in charge of trade license issuance. A UAE free zone is characterized by the benefits of 100% foreign ownership and tax concessions. A free zone company is authorized to trade only within the free zone and outside the UAE.

Offshore

An offshore company is a business entity that is set up with the intention of operating outside its registered jurisdiction and/or the location of its ultimate ownership. A company may legitimately move offshore for the purpose of tax optimization or to enjoy more suitable regulations.

AVAILABLE JURISDICTIONS

Establishing a company in any part of the world can be challenging – with a multitude of available jurisdictions in the UAE alone, how do you know which one works for you?

While this can depend on several factors like your business activity, company structure, and the necessity of a physical office space, our seasoned business setup consultants take away the hassle with personalized solutions that cater to your unique business needs.

Here are some of the best jurisdictions in the UAE:

Department of Economic Development (DED) Dubai Mainland

For businesses wishing to operate in Dubai and expand across the UAE, the Department of Economic Development Dubai Mainland enables direct trade with customers, other mainland businesses, and the provision of essential services from the government of Dubai.

Dubai Multi Commodities Center (DMCC)

A globally recognized and strategically located freezone, DMCC is ideal for corporate businesses that require a physical presence. With more than 19,000 companies registered to date, DMCC is a trade and enterprise center for commodities.

Jebel Ali Free Zone (JAFZA)

Best known for its world-class port and close proximity to major markets, Jebel Ali Free Zone is an economic trade hub for industrial businesses that require warehouse spaces and logistics infrastructure.

Meydan Freezone

Meydan Freezone is the place to be for freelancers and start-ups. With numerous competitive licensing options, this freezone provides a vast support system to new and emerging businesses entering the UAE market.

Ras Al Khaimah International Corporate Centre (RAK ICC)

RAK ICC is one of the world’s fastest-growing corporate registries. For businesses looking to setup an offshore operation in the UAE, RAK ICC offers the most time-efficient and cost-effective solution.

UAE Golden Visa

In addition to the business setup options which give foreigners short-term residency status, the Government of UAE has also established a successful long-term residency program. The UAE Golden Visa for investors in public projects and real estate secures a 10-year visa for qualifying applicants.

The minimum investment requirement is AED2M in the form of:

- A deposit in an investment fund in the UAE, or

- Purchased property or off-plan deal.

In some cases, there is a minimum mandatory holding period and restrictions to use loans for the investment. Benefits:

- Can include the spouse and children, as well as one executive director and one advisor;

- Extended period for stay outside of UAE for more than 6 months.

APPLICATION FEES

All application fees charged by the UAE government are subject to frequent change. These fees depend on the jurisdiction type, license activity, and complexity of the process.

Contact us to get a precise quote based on your needs and preferences

NEXT STEPS:

ARTON INDEX SCORE

0

- 0 cost

- 0 speed

- 0 global mobility

- 0 quality of life

- 0 simplicity

Updated yearly, the Arton Index is an overall assessment and comparative benchmark of the country and its investment program.

9,915,803

Population Growth: 0.58%

47,792 USD

GDP (per capita)

GDP (purchasing power parity)

686 billion USD

179

Visa free countries

LOCATION

Middle East

CAPITAL

Abu Dhabi

DIFFERENCE

UTC +4

TOTAL AREA

83,600 sq. km.

AGE DEMOGRAPHICS

0-14: 14.94%, 15-24: 12.36%, 25-54: 64.15%, 55-64: 6.59%, 65+: 1.96%

LANGUAGE

Arabic: 77%, English: 67%

RELIGIONS

Islam: 76%, Christianity: 9%, Hinduism: 8%, others: 7%

GOVERNMENT TYPE

Elective monarchy

CURRENCY

UAE Dirham (AED)

EXCHANGE RATE

1 USD = 3.67 AED