Industry News

Arton Capital and Wealth-X release a special report

- Posted on Apr 29, 2014

- In Events, Press releases

Demand for global citizenship programmes is primarily from the mideast but Asia is the next frontier.

Pakistan, Lebanon and Egypt have the highest number of UHNW second citizenship applicants, with nearly 40% of all applicants worldwide coming from these three countries.

Dubai/Singapore, 29 April, 2014 – Nearly 60% of applicants for second citizenship or second residence programmes come from the Middle East, but Asia is the new frontier with ultra wealthy Chinese and Indian nationals and non-residents likely to spur demand for these programmes in the next five years.

These are some of the key findings of a joint special report released today by Wealth-X, the world’s leading UHNW intelligence and prospecting firm, and Arton Capital, the global citizenship experts, at a Dubai forum on global citizenship.

Global citizenship programmes offer individuals and their families residency and citizenship options in a host country, with economic investment in a pre-defined list of assets within the country as a precondition.

The report, titled A Shrinking World: Global Citizenship for UHNW Individuals, also showed that the average net worth of a second citizenship applicant is well above the global average for UHNW individuals. Second citizenship applicants have an average net worth of US$205 million, compared to the global UHNW average of US$135 million.

The report also revealed that applicants have better liquidity, more than US$66 million per person, nearly double the global average of US$35 million. This means that these individuals can easily meet all the requirements for citizenship or immigrant investor programmes with their liquid investments.

Other highlights from the report include:

- Pakistan, Lebanon and Egypt have the highest number of UHNW second citizenship applicants, with nearly 40% of all applicants worldwide coming from these three countries. The United States and Russia are the fifth and sixth on the list of countries with the most applicants.

- Europe is the most popular region in terms of UHNW second citizenship applications, accounting for nearly half of the total number of applications.

- The relative affordability of these schemes can be as low as 0.1% of the net worth – equivalent to 0.5% of the liquid assets – of the average UHNW individual.

- The savings gained through participation in these schemes can be immense. For example, a UHNW individual moving from the US to Dubai can save nearly $1 million on capital gains tax alone.

- Billionaires are five times more likely to apply for second citizenship than an average UHNW individual.

The report highlights advantages a second citizenship offers to both the individual and their family as well as the country they are applying to. These including: stability and security, tax efficiency, ease of travel, a higher standard of living, better quality of life, increased options for their children’s education, and more widespread investment opportunities.

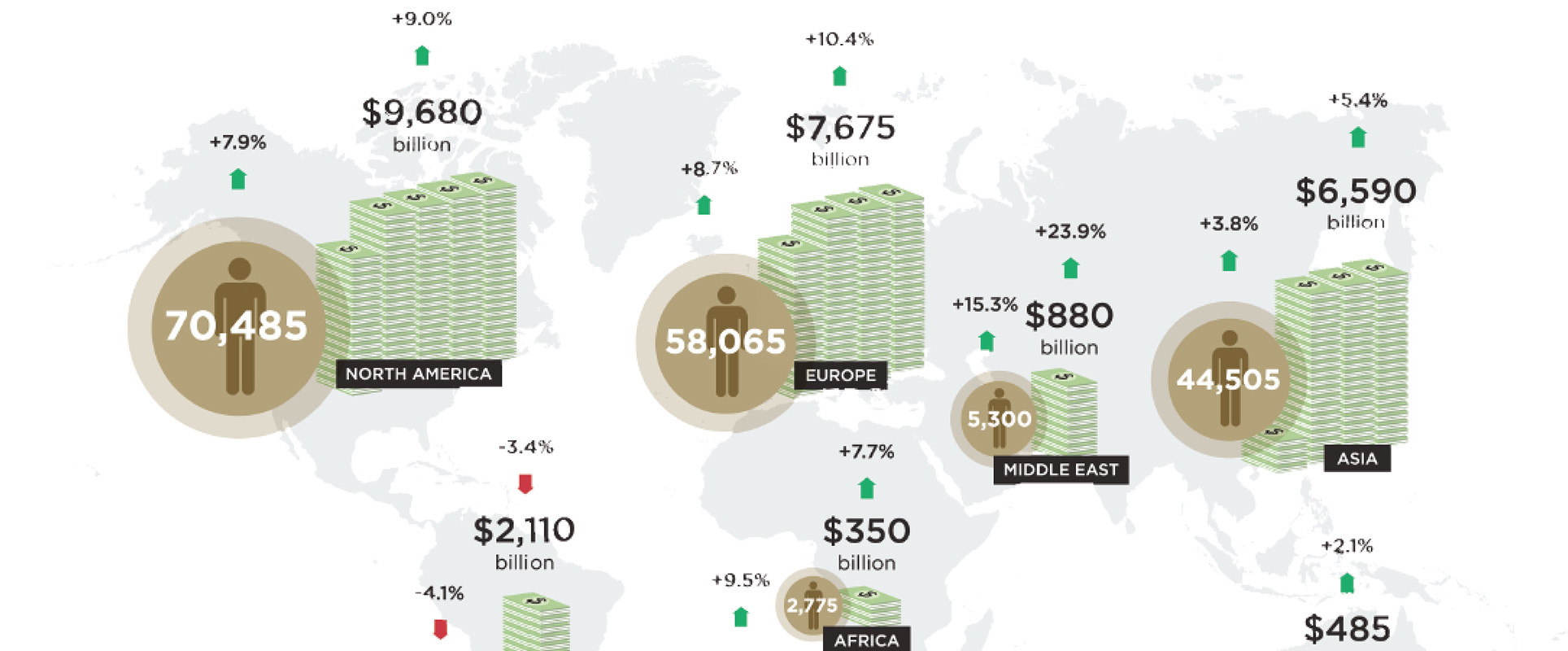

There are currently almost 200,000 ultra high net worth (UHNW) individuals (those with at least US$30 million in net assets) globally worth a collective $27,770 billion. Billionaires account for 1% of the world’s UHNW individuals holding 23% of the collective UHNW wealth, which represents US$6.5 trillion. It is predicted that by 2020 the billionaire population will grow by 80% the year 2020, an increase of 1,700 billionaires.*

Mykolas Rambus, Wealth-X CEO, said: “The trend of UHNW individuals applying for a second residence or citizenship looks set to continue in the coming years, particularly in Asia where trillions of dollars of new wealth will be created in the next decade and beyond.”

Armand Arton, President and CEO of Arton Capital, said: “We are witnessing the largest ever succession transition as wealth in excess of US$16 trillion transfers from one generation of UHNW individuals to the next by 2044. This transition is likely to create a surge in the number of UHNW individuals deciding to change their citizenship as the next generation considers their asset portfolio by identifying the most relevant market to invest in. Many of these international investment decisions are based on the benefits each geographical jurisdiction offers to these individuals and therefore global economies have the opportunity to attract substantial foreign direct investment.

“The Middle East has the highest proportion of billionaires in the world – 40% of global UHNWs. We are in the business of ensuring that our clients benefit from the freedom of choice and therefore we work closely with these individuals to select the country with the best investment and life style opportunities to ensure that the needs of both parties are perfectly balanced.”

*Figures from the 2013 editions of Wealth-X and UBS World Ultra Wealth Report and Wealth-X and UBS Billionaire Census

– Download your personal copy –

About Wealth-X

Wealth-X is the world’s leading ultra high net worth (UHNW) intelligence and prospecting firm with the largest collection of curated research on UHNW individuals, defined as those with net assets of US$30 million and above. Headquartered in Singapore, it has 13 offices on five continents. (www.wealthx.com)

About Arton Capital

Arton Capital empowers individuals and families to become global citizens through a high-end service and experience that simplifies complexity and is supported and sustained by long-term relationships. Arton plays a critical role in helping governments, consultants, legal and financial professionals and investors to meet their citizenship goals more quickly, efficiently and effectively.

Media Contacts

Mr. Fauzi Ahmad, Wealth-X | [email protected], +65 86536514

Ms. Nicola Hooper, Bell Pottinger | nhooper@bell-pottinger, +97155 886 2254

Related news

Arton Capital partners with Prestel & Partner

2024-09-11Arton Capital partners with Prestel & Partner

Arton Capital partners with Prestel & Partner, unlocking global citizenship for family offices. September 10th,

Arton, Press releases

Arton Group expands into software development with the acquisition of Sheppa Technologies

2023-01-24Arton Group expands into software development with the acquisition of Sheppa Technologies

Arton Group has announced the strategic acquisition of Sheppa Technologies, supporting the continued development of

Press releases

SHUAA and Arton announce partnership to encourage foreign direct investment in high growth markets

2020-11-17SHUAA and Arton announce partnership to encourage foreign direct investment in high growth markets

Dubai, United Arab Emirates, 18 November 2020: SHUAA Capital psc (DFM: SHUAA), the leading asset

Montenegro, Press releases

A Demand for Extraordinary Measures

2020-03-24A Demand for Extraordinary Measures

Arton’s global operations adjust to meet the increased demand for alternative residence and citizenship

Press releases